- 08.01.2026

According to the World Health Organization, raising excise taxes on tobacco and nicotine products is the most effective tool for reducing their consumption. The World Bank estimates that a 10% increase in the price of a pack of cigarettes reduces the consumption of tobacco products by 6-8% in low- and middle-income countries, which include Ukraine. That is why the tobacco industry consistently opposes any tax initiatives that could limit its profits.

Ukraine was no exception. Law No. 4115-IX “On Amendments to the Tax Code of Ukraine Regarding the Revision of Excise Tax Rates on Tobacco Products” caused a significant stir from the moment it was drafted until it was signed by the President, which was delayed for three months. This case has become a textbook example of the tobacco industry’s systematic interference in the process of shaping public health policy, resulting in the creation of conditions for maintaining the affordability of tobacco products for young people and billions of hryvnia in lost revenue for the state budget.

Having chosen an irreversible course towards European integration, Ukraine has committed itself to adapting its national legislation to EU law, in particular to implementing the requirements of Directive 2011/64/EU, which provides for the establishment of a minimum excise duty on cigarettes at a level of €90 per 1,000 cigarettes.

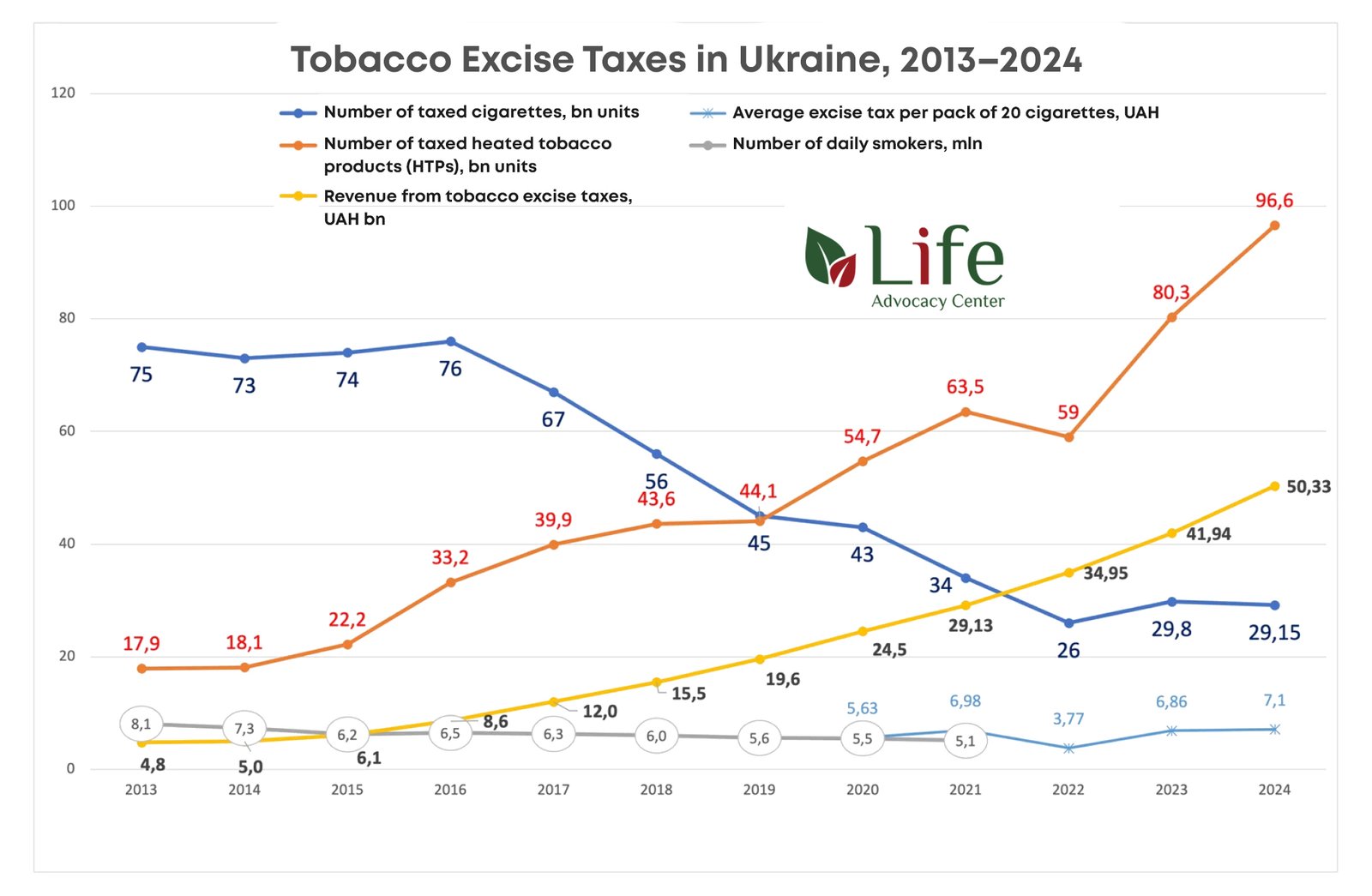

To this end, an eight-year plan was introduced for 2018-2025 to increase excise taxes on tobacco products by 20% annually, with an additional 9% increase from July 1, 2019. This was an effective strategy that contributed to a reduction in tobacco consumption among the population and also ensured budget revenues from this harmful product. In 2024, the Ukrainian state budget’s revenues from excise taxes on tobacco products and liquids used in e-cigarettes amounted to UAH 96.6 billion.

In 2021, Ukraine took another progressive step towards protecting young people from tobacco by harmonizing the excise tax on cigarillos and tobacco products for heating (HTPs, used with IQOS, plooom, and glo devices) to the level of the minimum excise duty on cigarettes. With this decision, Ukraine curbed the availability of HTPs, which at the time enjoyed significant regulatory preferences (unrestricted advertising, no health warnings, permission to smoke in public places), and ensured the stability of excise revenues to the Ukrainian state budget.

In just the first year of harmonized taxation, excise tax revenues on tobacco products increased sixfold compared to the previous year 2020, from UAH 1.7 billion to UAH 10.2 billion, and in 2024, this figure reached UAH 17.9 billion. In a letter to the President of Ukraine, the Director of the WHO noted this progressive decision as an example for the international community in protecting public health.

However, due to inflation and the devaluation of the hryvnia, caused in particular by the war, it became clear as early as 2022 that Ukraine would not reach the EU excise duty level in 2025, and therefore the plan to increase excise duties needed to be revised. The tobacco industry also realized the inevitability of this decision and began to apply its arsenal of tactics at the initial stage of policy formation.

At the end of 2023, the Ministry of Finance of Ukraine submitted for public discussion, and on March 18, 2024, registered in the Verkhovna Rada draft law No. 11090 “On Amendments to the Tax Code of Ukraine Regarding the Revision of Excise Tax Rates on Tobacco Products,” which proposed the following changes:

Positive decisions | Weak decisions |

Conversion of excise duty calculations on tobacco and nicotine products into euros to avoid the impact of devaluation. | Plan to increase excise duties on cigarettes to €90 per 1,000 cigarettes by 2028 (the minimum level in the European Union, as required by Directive 2011/64/EU). |

Setting the rate for e-cigarette liquids at €300 per liter in 2025. | Creation of a 25% excise tax preference for tobacco products for electric heating compared to cigarettes (€72/1,000 pieces by 2028). |

Therefore, the government proposed to extend the implementation of Directive 2011/64/EU, which is a requirement for EU accession, by 14 years after the signing of the Association Agreement between Ukraine and the EU.

The table below shows the weak dynamics of the annual increase in excise tax rates on cigarettes and tobacco products in 2026-2028 proposed by the Government.

Product/year | 2025 | 2026 | 2027 | 2028 |

Cigarettes (minimum excise duty obligation in euros/1,000 pieces) | 78 | 82 (+5,13%) | 86 (+4,88%) | 90 (+4,65%) |

HTPs (specific excise duty rate in euros/1,000 units) | 70,4 | 70,8 (+0,6%) | 71,14 (+0,5%) | 72 (+1,2%) |

% preference for HTPs compared to cigarettes | 10,8% | 15,8% | 20,1% | 25% |

As part of this initiative, the public, not affiliated with the tobacco industry, recommended:

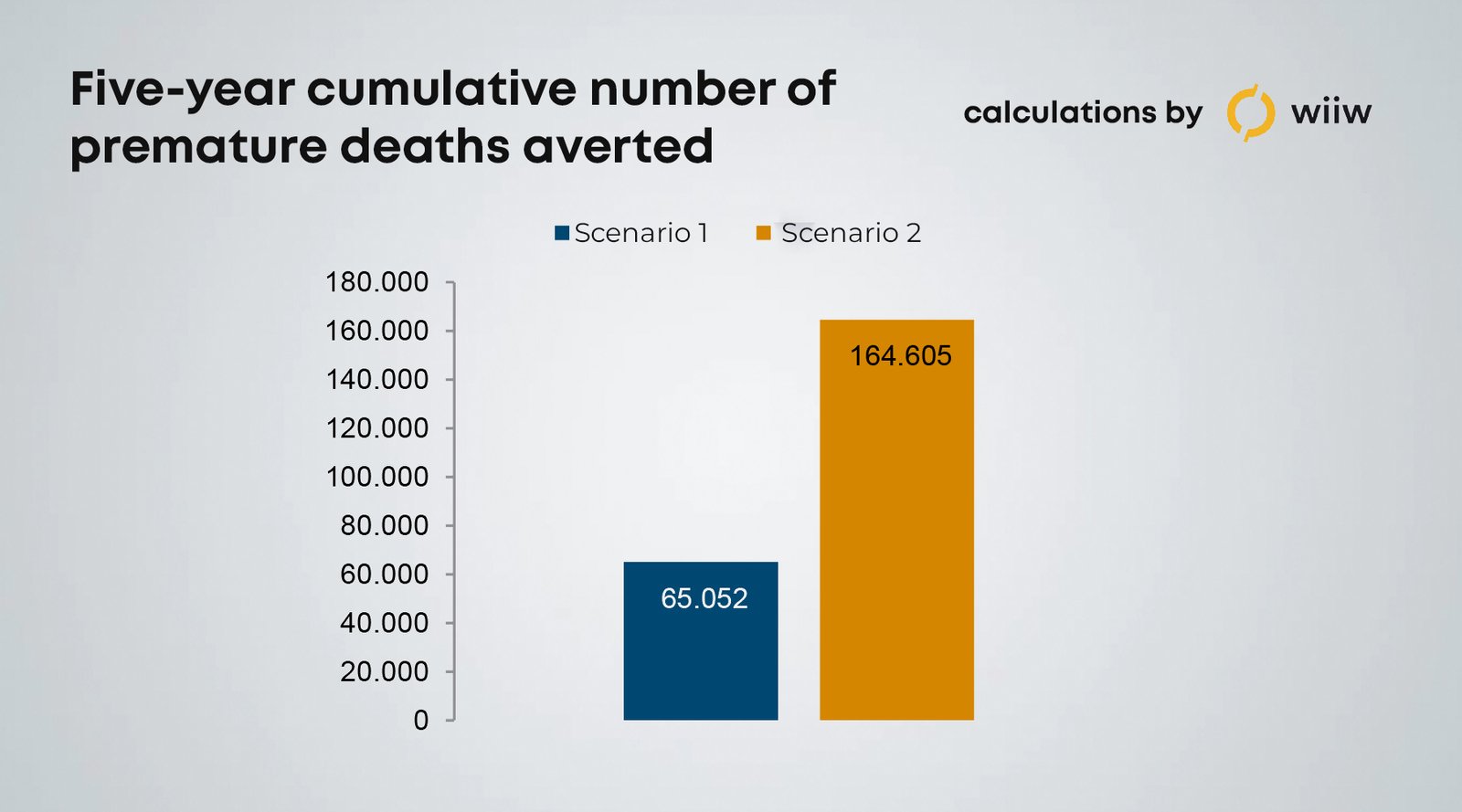

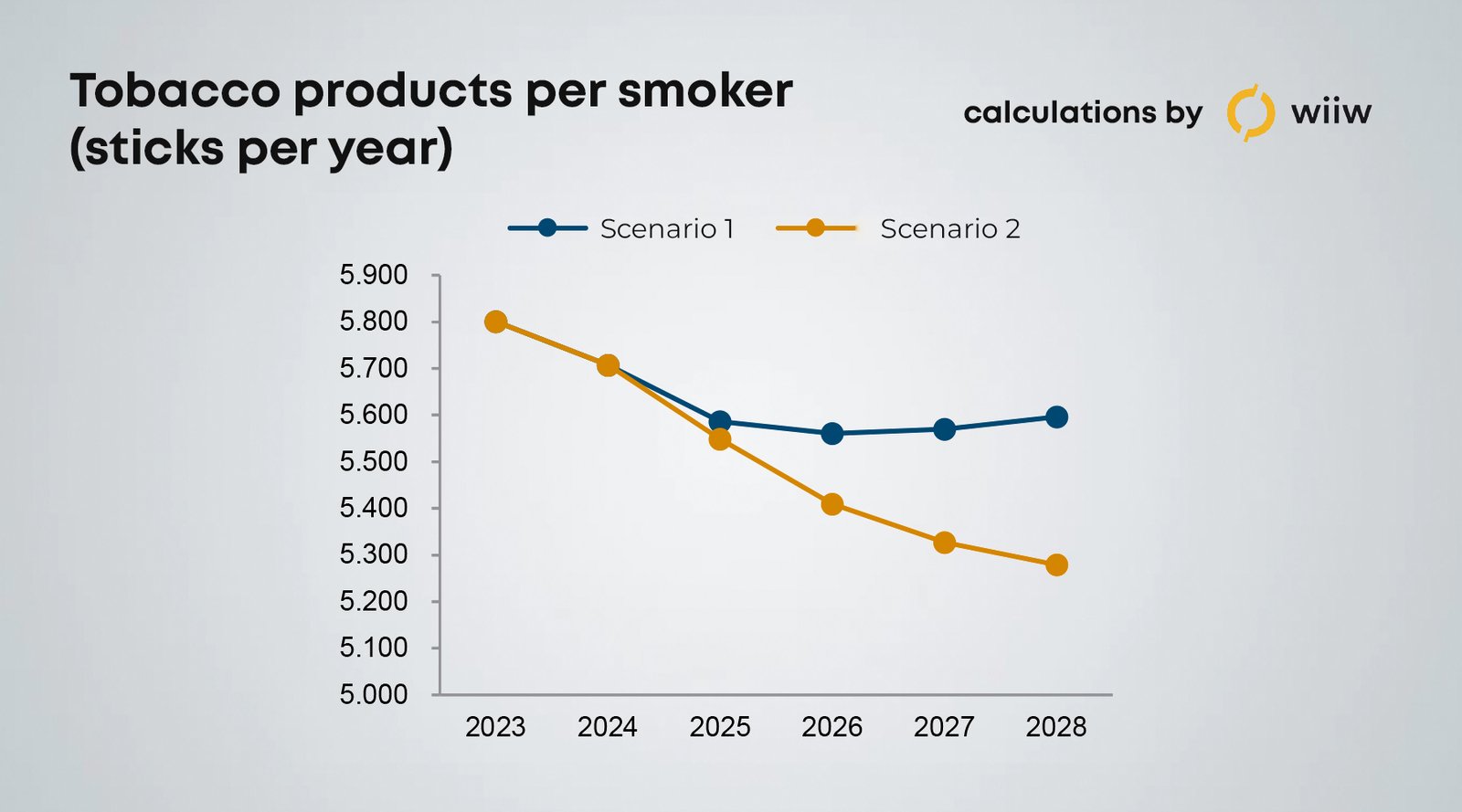

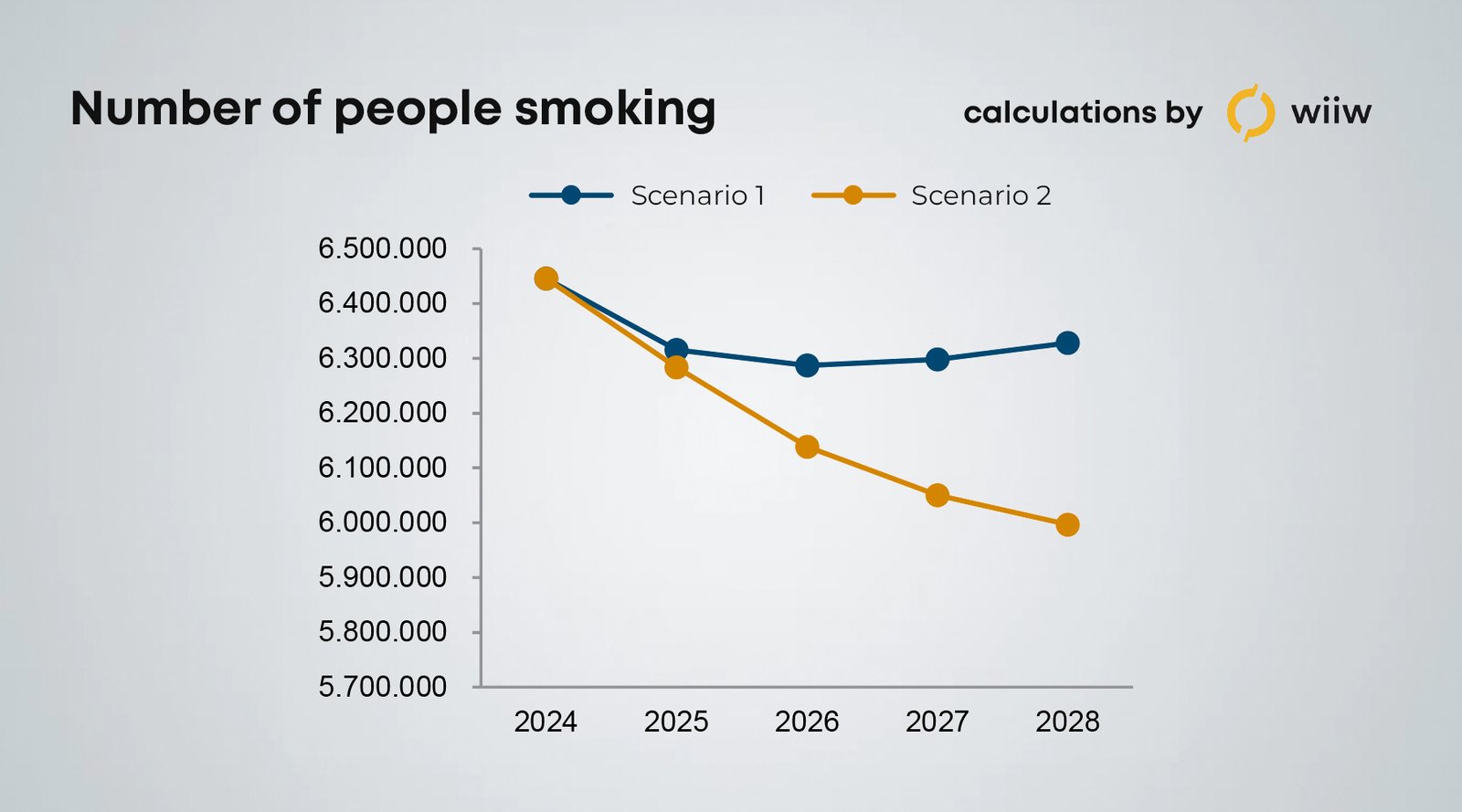

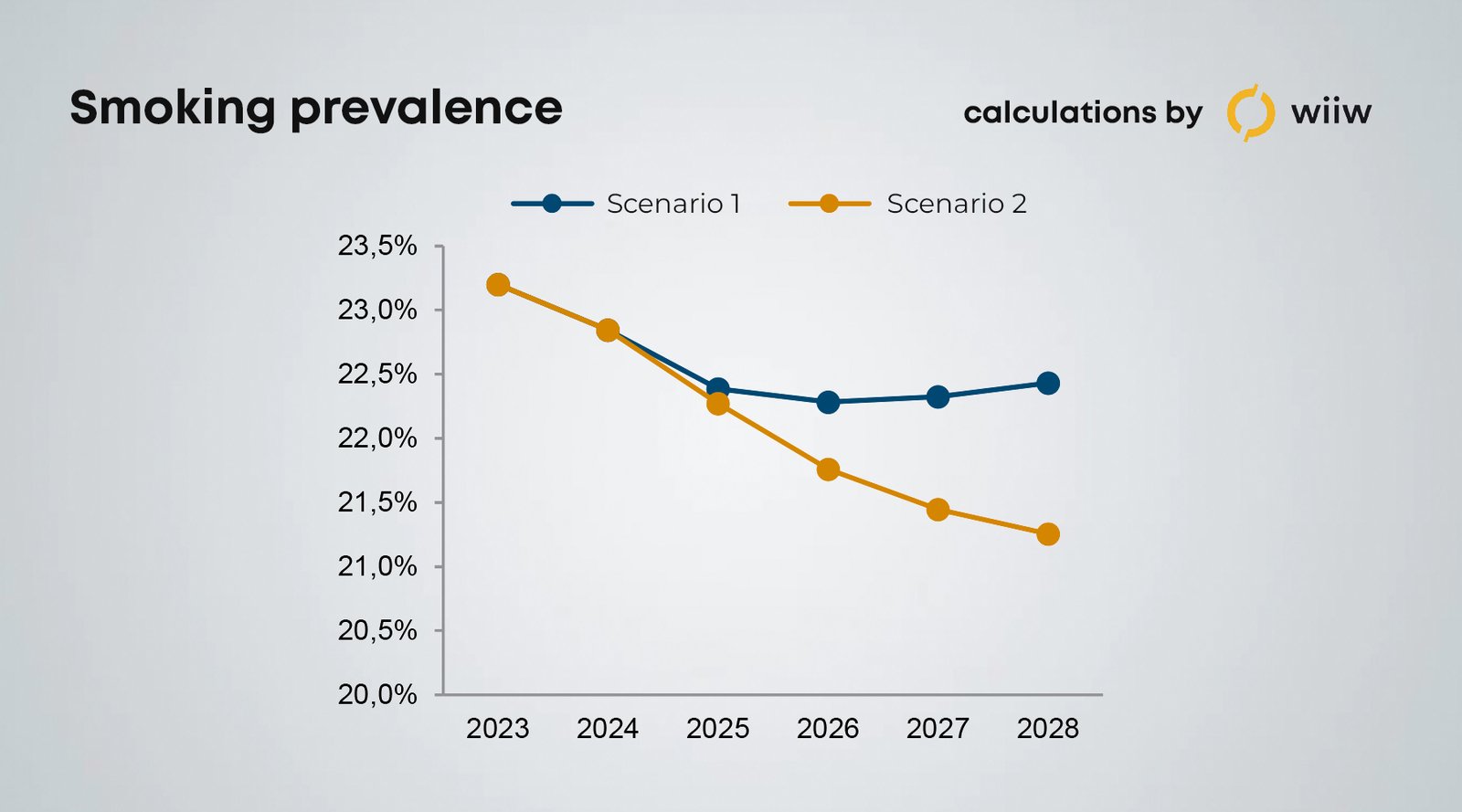

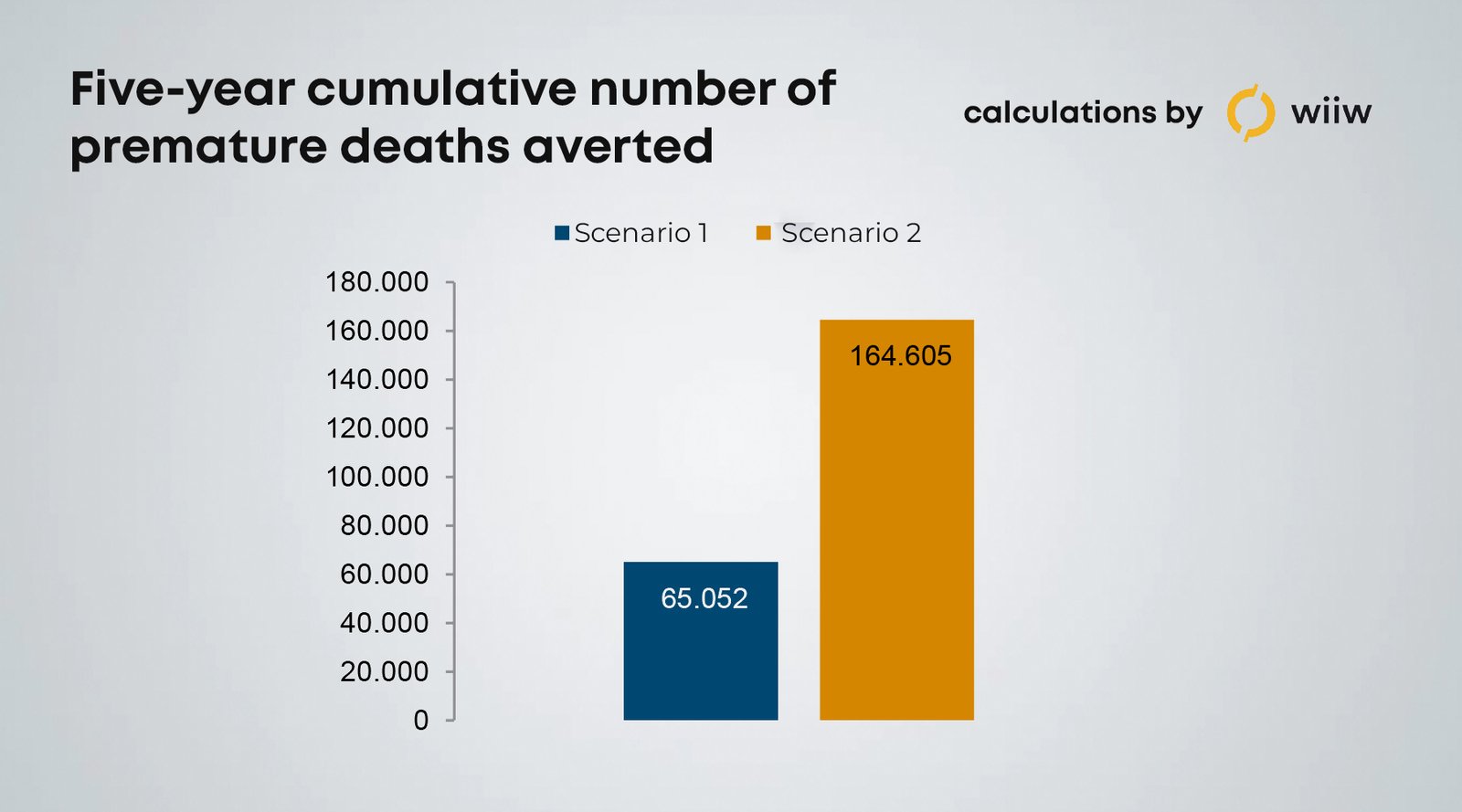

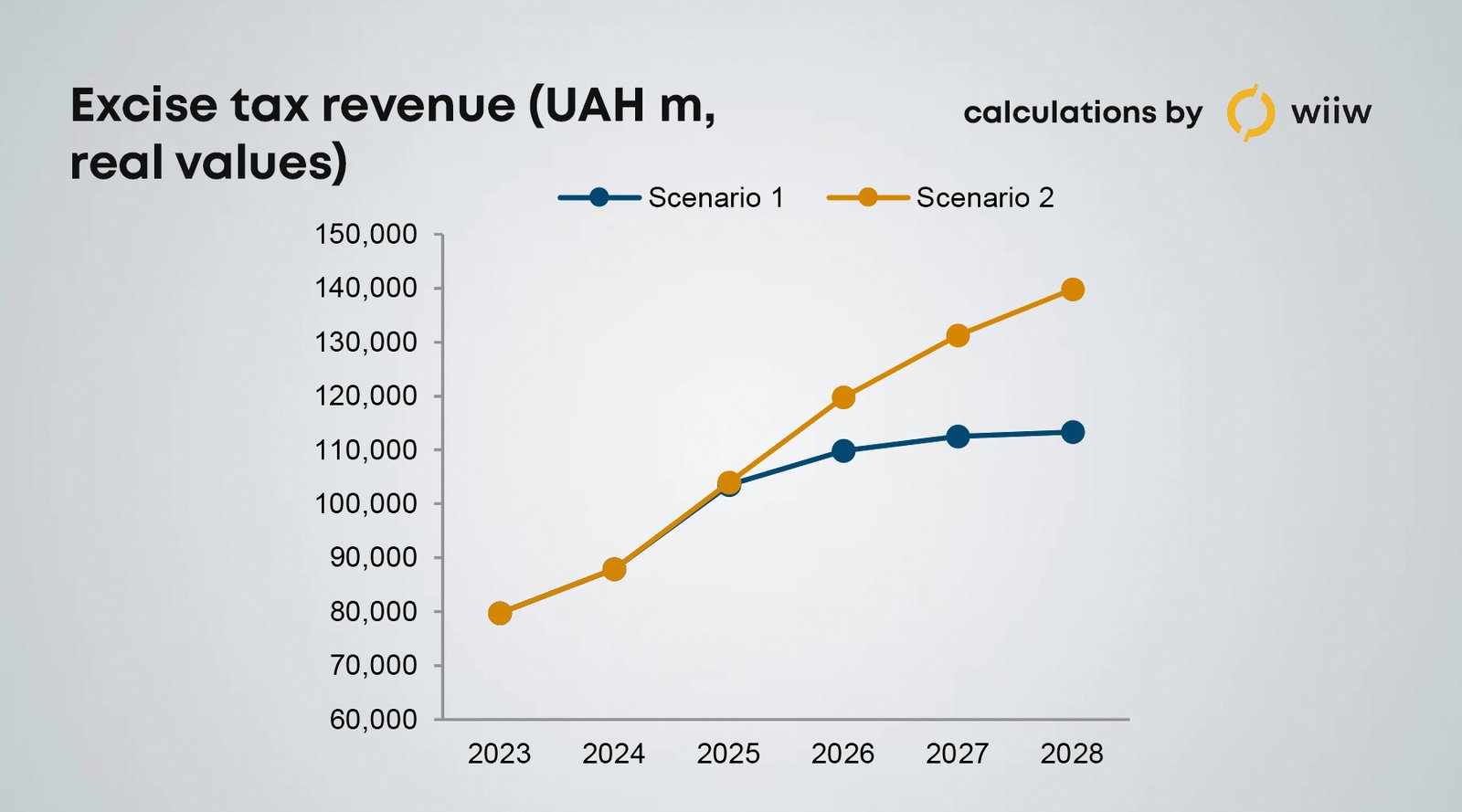

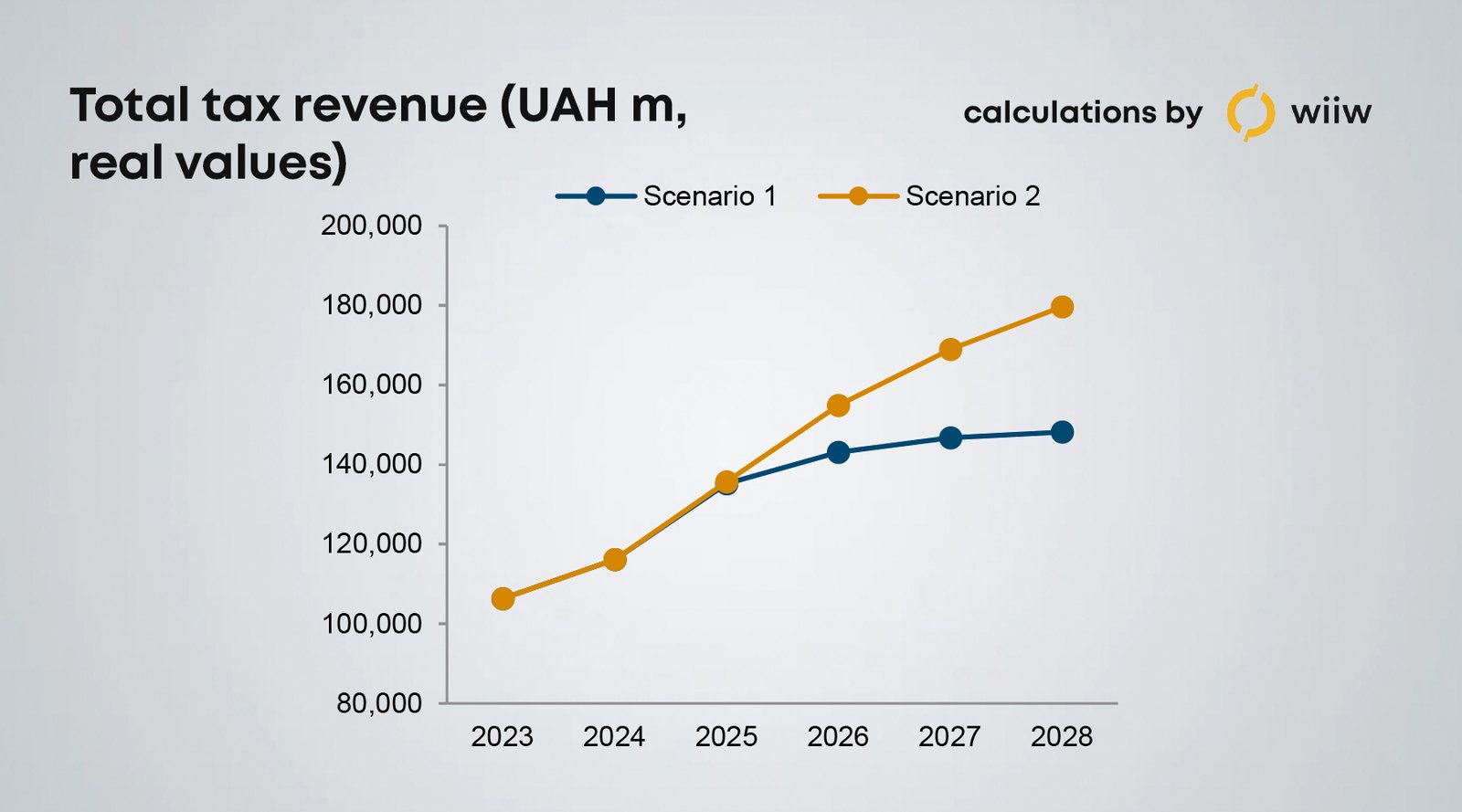

The table shows calculations of the results of various scenarios for increasing excise taxes on tobacco products until 2028

Excise tax rate per 1,000 cigarettes / HTPs | Consumption of tobacco products | Prevention of premature deaths | Revenues to the state budget |

90 / 78 euros proposal by the Ministry of Finance | Only a 3.3% decrease, and after 2026 will start to grow again* | Prevention of 65,000 premature deaths by 2028* | Raising an additional €3.69 billion (UAH 157.8 billion) by 2028* |

90 / 90 euros | Not calculated | Prevention of 87 485 premature deaths by 2028* | Raising an additional €3.84 billion (UAH 165.8 billion) by 2028** |

120 / 120 euros | Tobacco consumption reduced by 8.4% by 2028* | Prevention of 165 000 premature deaths* | Raising an additional €5.22 billion (UAH 223.7 billion) by 2028* |

*calculations by experts at the Vienna Institute for International Economic Studies (wiiw)

**calculations by experts at NGO “Life”

The graphs show the predicted consequences of two scenarios for increasing excise duties on tobacco products, according to calculations by experts at the Vienna Institute for International Economic Studies (wiiw):

Thus, despite numerous statements and indisputable arguments from the public, the Ukrainian government and parliament, under pressure from the tobacco industry, abandoned the effective practice of harmonized taxation of cigarettes and HTPs in favor of tobacco companies, two of which are international sponsors of the war, and introduced a weak plan to increase excise taxes on tobacco products, which will result in increased consumption of tobacco products, significant shortfalls in Ukraine’s war budget, and a widening gap with the level of taxation in the EU (divergence).

During the process of drafting, revising, and adopting Law No. 4115-IX, the tobacco industry and related interest groups actively used a set of established arguments aimed at justifying the introduction of tax preferences for heated tobacco products (HTP) and a modest increase in excise taxes on tobacco products. These included:

These arguments were put forward both by individual members of parliament who publicly or informally defended the interests of the tobacco industry, and through related organizations and initiatives that created the appearance of broad public support for the policy of reducing excise taxes on tobacco products.

Regulatory capture: industry interference in the development of the draft law

Law No. 4115-IX was drafted by the Ministry of Finance of Ukraine in cooperation with the tobacco industry, as openly stated by Deputy Minister of Finance of Ukraine Svitlana Vorobey [1].

Such actions by the Ministry of Finance of Ukraine in the interests of the tobacco industry violate Article 4 of the Law of Ukraine “On Measures to Prevent and Reduce the Use of Tobacco Products and Their Harmful Effects on Public Health” and international obligations undertaken in accordance with the ratified WHO Framework Convention on Tobacco Control (WHO FCTC). Article 5.3. The WHO FCTC stipulates: “In developing and implementing their public health policies to combat tobacco, the Parties shall act in such a way as to protect their policies from the influence of commercial and other corporate interests of the tobacco industry in accordance with national legislation.”

When drafting the law, the Ministry of Finance of Ukraine ignored the position of the Ministry of Health and expert public opinion, not affiliated with the tobacco industry, regarding the inadmissibility of creating a 25% tax preference on excise duties for HTPs and the need to introduce a more intensive schedule for increasing excise duties on tobacco products, which would reduce the affordability of tobacco products in accordance with the recommendations of the World Bank.

Representatives of the Ministry of Finance, who defended a weak plan to increase excise duty on cigarettes and tax preferences for HTPs:

Interference through members of parliament

A typical tactic of the tobacco industry is to influence the legislative process through political representatives and members of parliament. This manifests itself in facilitating the preparation of draft laws, introducing amendments that soften regulations, or blocking initiatives that restrict the sale and marketing of tobacco products. Lawmakers often act as intermediaries to promote the interests of the industry by participating in public discussions, committee meetings, and working groups, creating the illusion of political support for decisions that benefit the tobacco industry. This strategy allows them to influence legislation by masking their commercial interests under political or social arguments.

In particular, this tactic could be observed during the consideration of draft law No. 11090 in the Verkhovna Rada. A 25% excise preference for TVEN and a weak plan to increase taxes on cigarettes were strongly defended by individual MPs, some of whom had already been repeatedly spotted engaging in activities in the interests of tobacco companies. Among them were:

Lobbying through pressure groups

The tobacco industry actively uses pressure groups to promote its commercial interests. These are organized associations that systematically influence decision-making, policy, or public opinion in the interests of certain parties. They include business associations, industry associations, think tanks, and non-governmental organizations.

During the consideration of draft law No. 11090, this mechanism was used to its full extent. Representatives of influential groups participated in key meetings of the working groups of the Verkhovna Rada Committee on Finance, Tax and Customs Policy, opposed the sharp increase in excise taxes on cigarettes, and actively defended the 25% excise preference for HTPs, using arguments about the “lesser harm of HTPs,” the absence of an illegal market for these products, and the alleged rapid growth of smuggling of traditional cigarettes. During the meetings of the working group on draft law No. 11090, there were about 20 representatives of such organizations [1, 2].

This strategy aims to undermine the adoption of effective anti-smoking policies by promoting messages that serve the commercial interests of the tobacco industry.

List of organizations and structures that supported the government’s version of the law with a preferential approach to taxation of HTPs

Business associations

Industry and specialized associations:

Think tanks and expert platforms:

Involvement of scientists

The tobacco industry attempts to engage scientists to promote solutions that serve its commercial interests. Tobacco companies engage individual researchers or university structures to prepare conclusions that serve the interests of the industry. Such materials are presented as independent expertise, although in fact they reflect a biased interpretation of data or fragmentary research, detached from the global scientific consensus and current WHO recommendations. The use of the status of scientists allows the industry to put additional pressure on government agencies, giving its proposals the appearance of a professional position.

Thus, Natalia Tymchuk, a leading researcher at the Department for Research on Lawmaking and Adaptation of Ukrainian Legislation to EU Law at the Institute of Lawmaking and Scientific and Legal Expertise of the National Academy of Sciences of Ukraine, supported the provision of tax preferences for HTPs and reported that the relevant department had sent a scientific expert opinion on draft law No. 11090 and its compliance with Ukraine’s international legal obligations in the field of European integration and EU law [1].

Mykola Pasichnyi, an expert at the Growford Institute organization, systematically defends the interests of the tobacco industry and presents himself as a professor in the Department of Finance at the State University of Trade and Economics: he has prepared analytical notes and publications, participated in meetings of the Committee to discuss draft law No. 11090, and provided comments to the media that serve the commercial interests of the tobacco industry [1, 2, 13, 15].

Involvement of healthcare specialists

Even more cynical is the practice of involving representatives of the medical community. Tobacco companies use doctors or medical experts as public commentators who promote arguments about the “lesser harm” of HTPs or advocate for “gradual” approaches to regulation and taxation. Such voices are presented as the position of health representatives, although in fact they contradict tobacco control policies and the position of the WHO.

The use of medical professionals misleads society. Such actions contradict the ethical principles of the medical profession and discredit the medical community.

Tax preferences for HTPs were supported by appealing to the lesser harm of tobacco products, which directly contradicts the position of the WHO and the National Standards of Medical Care in Refusing Tobacco Use: Olha Sribna, senior physician at the Strazhesko Institute of Cardiology [16]; Yevhen Symonets, Thoracic Surgeon, Pulmonologist, PhD, Chairman of NGO “All-Ukrainian Respiratory Club” [3]; Olena Kvasha, Doctor of Medical Sciences [2].

Health experts released a series of publications on the “lesser harm” of HTPs during the consideration of the draft law to increase excise taxes. For example:

A tobacco-free future: innovative solutions in the Czech Republic to combat smoking – the Czech Republic is introducing the principle of harm reduction, in particular by taxing HTPs and electronic cigarettes at a lower rate than traditional cigarettes;

How can the harm caused by smoking be measured? – Doctor Olha Sribna refers to a study funded entirely by Philip Morris Products SA, promoting the effectiveness of the “harm reduction” approach;

Heated tobacco products are helping South Korea move away from traditional smoking. A study – a study on the effectiveness of the approach in South Korea, published in the tobacco industry trade media Tobacco Reporter;

Harmful habits and lung diseases: how to reduce the harm caused by smoking? – Doctor Yevhen Symonets calls the risk reduction strategy the most progressive one.

The WHO clearly states that there is no reason to believe that heated tobacco products are less harmful than other tobacco products. Independent studies show that the levels of 22 harmful substances in iQOS are twice as high as in conventional cigarettes, and the levels of seven other substances are 10 times higher than in conventional cigarettes. Thus, the use of HTPs is associated with the same risks to the pulmonary system as smoking conventional cigarettes.

In December 2024, the Antimonopoly Committee of Ukraine found that Philip Morris had misled consumers about the reduced harm of IQOS and ordered Philip Morris Sales and Distribution LLC to stop spreading inaccurate information

Manipulation of the IMF’s position

The final argument that ended the discussion in the Committee on Finance, Tax and Customs Policy regarding preferences for HTPs was Danylo Hetmantsev’s reference to the allegedly clear position of the International Monetary Fund on the need to tax HTPs lower than cigarettes [2]. In reality, the IMF did not require Ukraine to create preferences for HTPs, but only recommended a tax range of €49 to €90, emphasizing the need to find a balance between financial goals and health objectives [17].

In the context of a grueling war, demographic crisis, and chronic financial shortages, a rational and fair solution for Ukrainian society would be to impose uniform taxation on HTPs and traditional cigarettes. Thus, Danylo Hetmantsev’s position can be viewed as manipulation in favor of the tobacco industry.

The law was adopted by the Verkhovna Rada of Ukraine on December 4, 2024, and, in accordance with the transitional provisions, was to enter into force on January 1, 2025.

On December 9, 2024, the law was sent to the President of Ukraine for signing.

In accordance with Article 94 of the Constitution of Ukraine, the President of Ukraine is obligated to sign and officially promulgate a law within fifteen days of receiving it, or return it to the Verkhovna Rada of Ukraine with his reasoned and formulated proposals for reconsideration.

However, the law was returned with the signature of the President of Ukraine only on March 24, 2025, and officially published on March 25, 2025.

Thus, the entry into force of the adopted law, the provisions of which provided for an increase in excise taxes, was unreasonably postponed for almost three months compared to the deadline set by parliament.

Two of the three tobacco companies whose heated tobacco products are available on the Ukrainian market are the largest taxpayers in Russia among all multinational companies and have been listed by the National Agency for Corruption Prevention (NACP) as international sponsors of war.

In the context of the grueling war against Ukraine, the state has granted these companies tax preferences, effectively supporting businesses that finance armed aggression against Ukrainian cities. This decision is highly controversial from the point of view of ethics, security, and the state’s economic policy.

Every year in Ukraine, approximately 100,000 people die from diseases caused by tobacco use, another 325,000 lose their ability to work, and the economy loses approximately 3.2% of the GDP annually. Actions aimed at protecting the interests of the tobacco industry undermine not only the health of citizens, but also economic and demographic stability, as well as the overall capacity of the state.

The process of adopting Law No. 4115-IX is a prime example of systematic interference by the tobacco industry in the legislative process and clearly demonstrates the urgent need to strengthen the implementation of Article 5. 3 of the WHO Framework Convention on Tobacco Control in order to prevent the tobacco industry from influencing public policy.

Documents and materials evidencing the promotion of tobacco industry interests:

Koshchuk, T. The pitfalls of raising tobacco excise taxes. Ekonomichna Pravda. November 13, 2024.. URL: https://epravda.com.ua/columns/2024/11/13/721770/